Ethereum Price Prediction: Analyzing the Path to $12,000 Amid Institutional Adoption Wave

#ETH

- Technical Support Convergence: Current price near Bollinger Band support with bullish MACD divergence suggests near-term rebound potential toward $4,500 resistance zone

- Institutional Accumulation Accelerating: Exchange supply at 9-year lows combined with ETF inflows and corporate treasury adoption creates structural bullish foundation

- Long-term Growth Trajectory: Analysts project $12,000 price target by 2025 based on Google-comparable adoption curve and $700T traditional finance migration potential

ETH Price Prediction

ETH Technical Analysis: Current Position and Key Levels

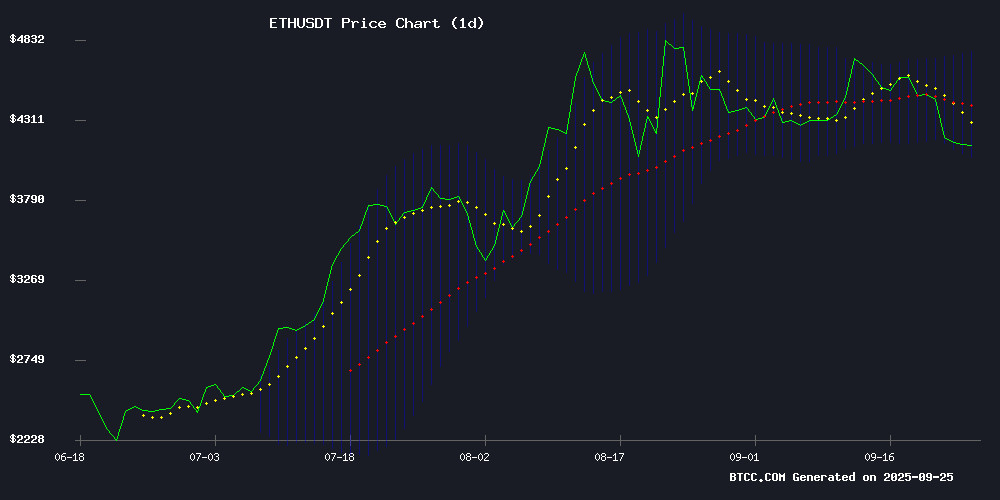

According to BTCC financial analyst Mia, ethereum is currently trading at $4,009.60, below its 20-day moving average of $4,405.50, indicating short-term bearish pressure. However, the MACD shows a positive divergence with the histogram at 33.68, suggesting potential upward momentum. The Bollinger Bands position the current price near the lower band at $4,037.48, which could act as support. The upper band at $4,773.53 represents near-term resistance.

Mia notes that while ETH is trading below key moving averages, the MACD bullish crossover and proximity to Bollinger Band support suggest potential for a rebound towards the $4,400-$4,500 range if buying momentum increases.

Market Sentiment: Institutional Accumulation vs Short-Term Weakness

BTCC financial analyst Mia observes conflicting signals in Ethereum's fundamental landscape. On one hand, exchange supply hitting nine-year lows combined with ETF inflows and institutional treasury adoption creates strong bullish underpinnings. However, short-term price weakness and economic shifts are creating near-term headwinds.

Mia highlights that institutional accumulation patterns, particularly the $700T traditional finance shift potential and Vitalik Buterin's Google growth trajectory comparison, provide strong long-term conviction. The current price dip may represent accumulation opportunities for strategic investors ahead of anticipated ETF-driven institutional flows.

Factors Influencing ETH's Price

Ethereum’s Price Tumbles as Economic Shifts Trigger Market Dynamics

Ethereum briefly fell below $4,000, hitting its lowest level since early August, before recovering slightly to $4,037. The altcoin recorded a 2.91% decline over 24 hours, pressured by a loss of support at $4,200 and broader market liquidations exceeding $1.7 billion.

The U.S. Federal Reserve’s 25 basis point rate cut failed to spur bullish momentum, with Chair Jerome Powell’s cautious stance further dampening sentiment. Institutional demand waned as spot Ethereum ETFs saw inflows plummet to $110 million in September from $3.8 billion the prior month.

Despite the sell-off, on-chain data points to accumulation by long-term holders, suggesting underlying confidence in Ethereum’s fundamentals.

Ethereum Exchange Supply Hits Nine-Year Low Amid Institutional Accumulation

Ethereum's exchange reserves have plummeted to 14.8 million ETH, marking the lowest level since 2016. Over 2.7 million ETH, valued at $11.3 billion, exited trading platforms in just 30 days—a 20% monthly decline that halved available supply since 2022.

Corporate treasuries and ETFs now control 10% of circulating ETH, creating a structural supply squeeze. Glassnode data reveals the exchange supply ratio at 0.14, a threshold last seen during Ethereum's infancy. This institutional demand clashes with long-term holders liquidating positions, creating opposing pressures that have trapped ETH near $4,000 despite bullish fundamentals.

The accelerated withdrawals—now at 2022 velocity levels—signal a paradigm shift in custody behavior. When digital assets migrate from exchanges to cold storage, it typically foreshadows prolonged holding periods and reduced market liquidity.

Ethereum Price Eyes 20% Jump as ETF Inflows Signal Institutional Confidence

Ethereum's price is poised for a potential 20% surge as institutional interest mounts, with ETF inflows hitting $556 million. Analysts project ETH could breach the $5,000 threshold, a milestone reflecting broader market maturation.

The rally extends beyond Ethereum itself, serving as a catalyst for decentralized finance (DeFi) tokens. Projects like PayDax Protocol (PDP) are gaining attention for their real-world utility in disrupting traditional banking models through decentralized lending and insurance solutions.

This institutional endorsement validates Ethereum's role as DeFi's foundational layer. The anticipated capital inflow promises to deepen liquidity and accelerate innovation across the ecosystem.

Uniswap’s Ownerless Contract Aims to Streamline Cross-Chain Transactions

Uniswap Labs has introduced "The Compact v1," an ownerless ERC-6909 contract designed to tackle cross-chain fragmentation in blockchain networks. This innovation provides a secure, reusable framework for resource locks, facilitating smoother cross-chain transactions. By offering a shared system for developers, The Compact enhances interoperability across diverse blockchain ecosystems.

The contract allows sponsors to deposit tokens, creating resource locks represented by ERC-6909 tokens. These locks remain under the sponsor’s control but can support multiple "Compacts," which serve as verifiable commitments outlining asset claim conditions. Key components include Allocators to prevent double-spending and Arbiters to verify commitment fulfillment.

Independent audits have confirmed The Compact’s security, with early adoption by LI.FI and Rhinestone signaling industry confidence. This development marks a significant step toward more composable and customizable cross-chain solutions.

SharpLink CEO Targets $700T TradFi Shift to Ethereum Blockchain

SharpLink Gaming CEO Joseph Chalom unveiled ambitious plans to migrate the $700 trillion traditional finance market onto Ethereum's blockchain during Korea Blockchain Week 2025. The executive positioned decentralized finance as the solution to systemic inefficiencies plaguing legacy systems, emphasizing blockchain's capacity for instant settlement and programmability.

With SharpLink's treasury holding 838,000 ETH ($3.86 billion), Chalom signaled strong institutional conviction in Ethereum's infrastructure. The move reflects growing recognition of blockchain's potential to eliminate settlement friction in capital markets—a pain point far more consequential than cryptocurrency's current $4 trillion valuation suggests.

Tom Lee Forecasts Ethereum Surge to $12K by 2025 Amid Institutional Adoption

Fundstrat co-founder Tom Lee positioned Ethereum as Wall Street's blockchain of choice during Korea Blockchain Week 2025, citing its neutrality as critical for institutional adoption. The Trump administration's pro-crypto stance reportedly aligns with Ethereum's decentralized framework, creating regulatory tailwinds.

BitMine's staggering treasury growth—from $37.6 million to $9.45 billion after adopting an Ethereum-centric strategy—demonstrates institutional conviction. With 2.15 million ETH holdings, the firm now controls the largest Ethereum treasury globally.

Lee's $12,000-$15,000 price target reflects Ethereum's dual appeal: a neutral infrastructure for traditional finance and a policy-friendly platform for government adoption. "Wall Street only operates on neutral chains," Lee asserted, drawing a clear distinction between Ethereum and centralized alternatives.

Analysts Predict Ethereum 'Supercycle' as Institutional Adoption Accelerates

Ethereum is emerging as the focal point of crypto's convergence with traditional finance, with analysts now seriously debating the potential for an ETH 'supercycle.' The narrative centers on Ethereum's infrastructure becoming the backbone for asset tokenization, institutional DeFi, and global settlement networks—a shift that could propel altcoins across the ecosystem.

Price projections reflect growing institutional confidence. Citibank forecasts ETH reaching $6,000 by year-end, a 50% surge from current levels, while some analysts speculate on a $10,000 target. The pipeline of regulated products, including spot ETH ETFs, adds credence to these bullish outlooks.

Tom Lee of Fundstrat captures the sentiment: 'Bitcoin proved digital value is real. But Ethereum is how you tokenize the real world.' The remark underscores ETH's positioning as the programmable layer for Wall Street's blockchain adoption.

Vitalik Buterin Compares Ethereum's Potential to Google's Growth Trajectory

Ethereum co-founder Vitalik Buterin has drawn a striking parallel between the blockchain's future and Google's historic rise, suggesting low-risk DeFi applications could become Ethereum's equivalent of the search giant's core revenue engine. The analogy positions lending protocols and real-world asset platforms as foundational elements rather than speculative NFT or meme coin ventures.

Google's dominance stems from its search advertising business, which funds peripheral projects. Buterin sees Ethereum's sustainable growth similarly rooted in financial utilities like stablecoin lending and tokenized real estate—tools aligning with the network's original vision of democratizing finance. This shift would advantage fundamentally sound projects over hype-driven tokens.

The comparison underscores a maturation phase for Ethereum, moving beyond experimental use cases toward durable value creation. As DeFi protocols approach the reliability of traditional banking services, they may unlock the network's long-predicted mainstream adoption—mirroring how Google's search monopoly enabled its expansion into adjacent technologies.

Ethereum Holders Diversify into Remittix Amid Short-Term ETH Weakness

Ethereum's price struggles with bearish momentum, dropping 7.5% this week to hover near $4,167. Technical indicators show weakening momentum, though bulls attempt to defend current support levels.

Despite ETH's volatility, holders remain confident in its long-term prospects while simultaneously backing Remittix—an Ethereum-native PayFi solution that has raised $26.4 million. Priced at $0.1130, Remittix combines utility, adoption potential, and security, positioning it as a favored low-cap altcoin.

Analysts project Remittix could deliver 500x gains by 2030, attracting ETH traders seeking high-growth opportunities beyond Ethereum's near-term uncertainty.

Ethereum's Buterin Advocates for System-Wide Transparency as Retail Presale Gains Momentum

Vitalik Buterin, Ethereum's co-founder, has intensified his advocacy for comprehensive transparency across digital and physical systems. In a recent blog post, he emphasized the necessity of open-source code, verifiable hardware, and privacy-preserving cryptography to safeguard freedom in an increasingly interconnected world. Technologies like ZK-SNARKs and differential privacy were highlighted as critical tools to balance transparency with user confidentiality.

The call comes amid growing concerns over centralized voting infrastructure and proprietary health tech. Buterin drew parallels to COVID-19 vaccine disparities, arguing that global systems must remain inspectable to prevent power concentration. His vision aligns with Ethereum's role as a foundational layer for open infrastructure.

Meanwhile, retail investors are capitalizing on meme-driven projects such as BullZilla ($BZIL), which has delivered significant returns during its presale phase. The trend underscores the market's appetite for high-risk, high-reward opportunities alongside Ethereum's more stable, long-term value proposition.

Ether Treasuries Gain Traction as Institutional Demand Surges

Ether is rapidly emerging as a cornerstone of digital asset treasuries, according to a new report from Bitwise Asset Management. Once dominated by bitcoin, these portfolios are now allocating to ETH at scale, creating structural demand that outpaces net new supply.

"ETH treasuries are no longer a side story. They are becoming a structural pillar in crypto's capital markets," wrote analyst Max Shannon. The demand is further bolstered by real yield from transaction fees and maximal extractable value, reinforcing ether's scarcity narrative.

Bitwise notes that the top five ETH treasuries reflect diverse strategies—from corporate accumulation to foundation divestments funding ecosystem development. This underscores ETH's dual role as both a reserve asset and yield-bearing instrument.

Tom Lee's BitMine Immersion Technologies now controls over 2% of ETH's supply after raising $365 million to expand holdings. The trend signals ether's evolution beyond speculation into a programmable treasury asset bridging corporate finance and on-chain economics.

How High Will ETH Price Go?

Based on current technical and fundamental analysis, BTCC financial analyst Mia projects Ethereum could reach $12,000 by 2025, representing approximately 200% upside from current levels. The prediction considers both technical rebound potential and accelerating institutional adoption.

| Timeframe | Price Target | Key Drivers |

|---|---|---|

| Short-term (1-3 months) | $4,500-$4,800 | Bollinger Band mean reversion, MACD momentum |

| Medium-term (6-12 months) | $6,000-$8,000 | ETF inflow acceleration, institutional treasury adoption |

| Long-term (2025 target) | $10,000-$12,000 | Supercycle institutional adoption, traditional finance migration |

Mia emphasizes that while short-term weakness persists, the combination of technical support levels and strong fundamental tailwinds creates favorable risk-reward dynamics for strategic accumulation at current levels.